What Kills A Bull Market?

Not a week goes by when I do not field questions about what direction the market is heading.

“The media pronounces that tomorrow at 9:30 sharp the market is going to crash.”

“The market is going down because of the presidential job approval”.

“The market is toast because of BREXIT.”

“The market is going to bust because of the stars aligned and it is the Age of the Aquarius.”

The only reliable indicator that I have followed over the years is tracking quarterly GDP numbers. As you know, GDP stands for Gross Domestic Product. And this number really gives us a feel what really is going on in the economy. Positive numbers are good. Negative numbers are bad. Bull markets do not die of old age, but rather of recessions. And recessions are normally cause by negative or long-term weakening of GDP quarterly numbers.

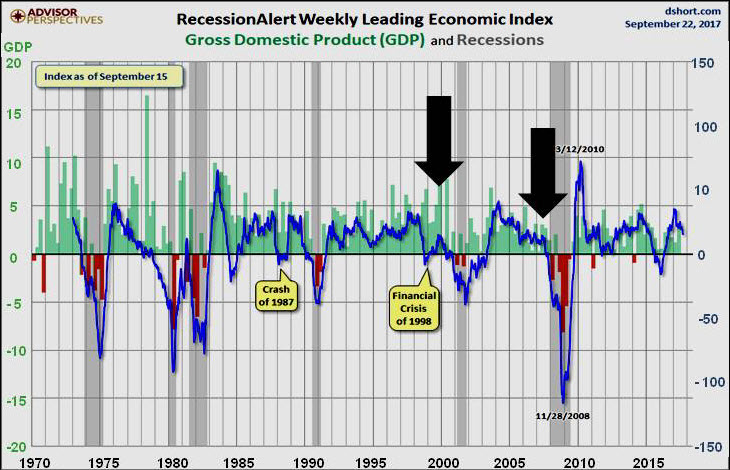

Check out this chart out below:

[1] https://www.advisorperspectives.com/dshort/updates/2017/09/22/recessionalert-weekly-leading-index-update

The solid line is a measure of quarterly GDP numbers. The grey area represents recessions. The solid blue line represents the GDP numbers starting to trend down in 1999-2000 and the stock market dropped - BOOM, we were in a recession. Same thing happened in 2007-2008. The GDP numbers started trending down, the market went down, and then we experienced The Great Recession.

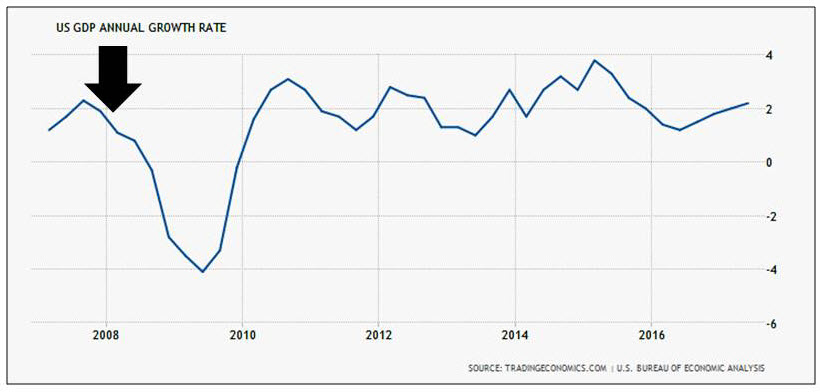

This second chart I included below is a little easier to read than the first. It's a diagram that shows quarterly numbers from 2007-2016. As you can see, at the start of 2008, we started experiencing negative GDP numbers – BOOM, a bear market happened and the great recession hit. The quarterly GDP numbers are published- wait for it- quarterly. The last quarter was 3.01%. And according to the Bureau of Economic Analysis, in the last 14 quarters, we have had only one negative quarter.

[2] https://tradingeconomics.com/united-states/gdp-growth-annual

While it might seem more valid to try and link the market movement with the presidential job approval, doomsday talk, and/or the alignment of the starts, I have found that this indicator is much more reliable as well as published. You can find it on the web in multiple places -just type in the words Quarterly US GDP Numbers.

Sincerely,

John Romano, CFP®

References:

1. https://www.advisorperspectives.com/dshort/updates/2017/09/22/recessionalert-weekly-leading-index-update

2. https://tradingeconomics.com/united-states/gdp-growth-annual

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years experience in the financial field. John is a Registered Representative with Securities America, Inc. (member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida and surrounding areas. He is a member in good standing of the Financial Planning Association (FPA).

The opinions and forecasts expressed are those of the author, and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated.

Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated.

305 Skyline Drive, Suite 3, Lady Lake, FL 32159

Phone: 352-753-8590

Email: John@RomanoJohn.com