Annuities-Good Bad Ugly

- Do you have the Annuity Blues ? (1,2) - Is your annuity not working the way you thought it would? Are your returns much lower than the market returns? Are you an annuity orphan or even know what an annuity orphan is? Are you stuck every year deciding the index strategy? If you answered yes ...READ MORE

- 5 Reasons to buy Fixed Indexed Annuities (1,2) While no one can predict the next bear market most investors today understand there are different cycles of the business of expansion and contraction and there are different cycles in the stock markets, bull and bear markets. For example from 1981 to 1999 we ...READ MORE

- Why you should put the least amount of money into Fixed Annuities (1,2) bet you don't hear it often, but if you're going to use fixed index annuities (FIA's) as part of your investment portfolio, make sure you put the least amount in to get the job done. This way the bulk of your money can be positioned into long-term growth. Most investment advisors like myself that have also been in the business for decades know the importance of...READ MORE

==============================================================================

1. Guarantees are based on the claims paying ability of the insurance company

2. Situations contained in articles are hypothetical examples provided for illustrative purposes only.

==============================================================================

DO YOU HAVE THE ANNUITY BLUES ?

Is your annuity not working the way you thought it would? Are your returns much lower than the market returns? Are you an annuity orphan or even know what an annuity orphan is? Are you stuck every year deciding the index strategy? If you answered yes to these questions, you might have the annuity blues.

JOHN, WHAT'S GOING ON HERE?

A couple of weeks ago, somebody sent me an email: Hey John, I'm going to take you up on your free offer. I would like to talk to you about my situation. So, my office called him and set up a date and time to talk, and I gave him a call. The nice gentleman said, “I've kind of been a do-it-yourself investor my whole life, and I'm getting a little tired of that, but I want to tell you my situation:

“About seven or eight years ago, I put about $200,000 in different kinds of basic domestic equities, and at the same time, I had put $200,000 into a fixed index annuity. Fast forward to today, seven-eight years later my equity-type portfolio is worth $400,000 - $450,000, and my annuity has only gone up about $50,000. I don't really understand what's going on here, but last year in 2017, my equity portfolio did 17%, and my annuity only did 3%.” He said, “Can you explain to me why this is? And by the way, my insurance agent has left the business, and I have no idea on how to choose these indexes the companies keep giving to me.”

I responded, “I'll tell you what, email me those statements, and we'll set up a time to give you a call, and there might be a couple of different things you can do.”

WHAT CAN HE DO?

So, I looked at the different accounts and saw that the indexed annuity product he had, had about eight or nine different index selections. So, I gave him a call and said, “Hey, I've got good news for you. Sometimes annuities are – I don't want to call them out of date, but maybe they just don't have the right options. And if they don't have the right options, you can always roll them into another one without triggering any taxes, but in your case, you don't have to do that because I've looked at these different options in here, and it looks like you've been in the fixed interest option for all these years.”Probably the reason for the underperformance was the selection of the interest option. And he said, “Well, I don't understand what these different indexes do. I understand what most indexes are, but I don't understand caps. I don't understand participation rates, and every year, they apparently change these things.”

I briefly explained to him what could be done. I told him, “You have to look at this almost like as an investment type product with different selections, and you've got to choose the right markets going forward.

I believe that the products are so sophisticated now and the average insurance agent (I'm not trying to belittle them) doesn't understand. What I mean when I say “they don't understand” is, well, most of them don't even have any securities licenses, so they haven't proved their competency by taking the basic securities testing. I think the products have gone off and left them. So, I believe you should utilize a top-notch investment advisor because you're picking from different segments of the market, just as if you were picking stocks or ETFs. There is good news, and it's that there are more options to choose from. The bad news is that most people, especially the layperson, are just going to be like you and they are going to look at these statements, and they are going to turn around and say, “Let it ride.”

So he says, “You know, could you help me do that?” And I said, “Sure. It won't take me five minutes. I spend my whole professional life studying different indexes and markets, and I have had 30 years of experience helping people.” You know, unfortunately, with these contracts, all the commissions are paid on the front end, but you've got your whole life savings in there. And they've been underperforming for five or six or seven years.

============================

Is your current annuity not performing ?

You know, the market has been giving double-digit returns for years. However, you aren't seeing it. Are you confused about your income options? Do you have an income rider that you don't understand? Are you an annuity orphan? Well, maybe I can help. I certainly would be glad to. You don't even have to come to the office, just shoot me an email or give me a phone call. I will either contact you directly or respond to your email. If you want to set up a time to talk to me on the phone, give my office a call.

============================

Sincerely, John Romano CFP®

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years experience in the financial field. John is a Registered Representative with Securities America, Inc. (member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated.

Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated.

John Romano, CFP®

305 Skyline Drive, Suite 3, Lady Lake, FL 32159

Phone: 352-753-8590

Email: John@RomanoJohn.com

FIVE REASONS TO BUY A FIXED INDEX ANNUITY

REASON #1: You have bear market insurance

While no one can predict the next bear market most investors today understand there are different cycles of the business of expansion and contraction and there are different cycles in the stock markets, bull and bear markets. For example from 1981 to 1999 we had what was called a secular bull market, and if you were an investor back in 2000 you know, it ended very badly. We went into a bear market, and the market dropped about 50%. And in the next 3 or 4 years after that we had a bull market and then during the crash of 2008 the market dropped 57%.

Now here's the good news: we've been in a 10-year bull market since 2009. And nobody knows when exactly the next bear market is. So this might be a good time to consider having bear market insurance.

It might be time to take some money off the table. The only way I know to do that is to move part of your portfolio into something that has guarantees of not losing principle and also not losing your accumulated gains. An option available to you is to take a percentage of your assets that may be at risk in equities and purchase a fixed indexed annuity. If you are going to purchase an insurance contract that gives you guarantees, you will have upside potential normally with limits, but you'll have downside protection. That means that you'll have limited participation on the market indexes going up, but if the market drops 50%, you're not going to see a statement that shows you're down 50%.

REASON #2: Participate in limited upside market performance.

Most retired investors have diversified portfolios that have traditionally been proportioned between bonds, CDs, Treasury, and equities. If you've been in equities the last ten years, I don't know how you couldn't be doing well. But perhaps you look at the other part of your portfolio that's more in conservative, yielding type of investments and see your returns have been very minimal, maybe 1 or 2%.

Economist Roger Ibbotson published a White Paper in 1979 that revolutionized the financial planning industry. What he did was produce was a 90-year chart that showed the difference in returns between stocks, bonds, and Treasuries. And in this report, the equities normally outperformed bonds 2:1. Just recently in March of this year, he came out with another study. He used the same methodology to compare fixed indexed annuities with bonds, CD's, and Treasuries. He went back and used historical data, and his findings were just this, stocks still outperformed bonds 2:1 (now I would tell you in the last ten years it's probably more like 3:1 because as you know interest rates have been so low and equities have done so well). So, he added FIA's as an asset class, and this was his findings: equities outperformed bonds, but fixed index annuities as an asset class outperformed bonds too. From my own experience, I've seen fixed index annuities do somewhere between 4-5%. I think I've seen Treasuries and CDs closer to 1.5-2.5% in the last ten years. https://dta0yqvfnusiq.cloudfront.net/commo93759149/2018/02/Ibbotson-White-Paper-5a78d2dea0f40.pdf

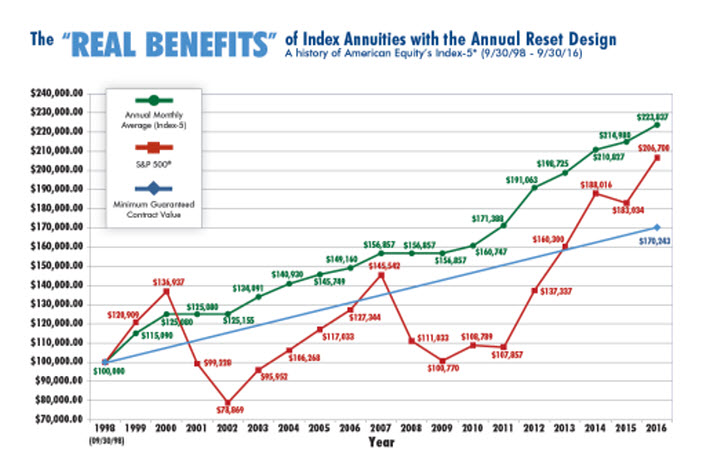

Look at the performance of this American Equity FIA in the last 20 Years. As you can see from this illustration from American Equity, a life insurance selling annuities, it shows the performance since 1998. Now as we talked about before, the performance also includes two bad bear markets. The bear markets are just part of the process. It's like breathing in, breathing out. You can see in this illustration what happened. So in the good years for the market, the market outperformed the fixed index annuity, but the reason why the annuity performed well is that it did not experience any 50% draw down.

https://media.american-equity.com/Documents/8109-10.21.16.pdf

REASON #3: Annuities have no memory – you keep what you kill

You know all investors are certainly excited after having a great ten years. They're looking at their statements after ten years and saying, boy I'm a lucky person. But did you realize in equities there's no lock down in there?

I have always been a fan of the actor Vin Diesel. I think one of the best movies I have seen that he starred in was called Riddick. He was fighting this whole empire called the Necromongers. The whole theme of it all was that you took what you wanted by force, and you kept what you killed. Basically, if you took over a planet, it was yours. And you're saying, John, what does this have to do with fixed asset annuities?

Well, what annuities allow you to do since they have no memory, at the end of every anniversary your return is locked in. In equity portfolios, your return is not locked in so if the market goes down not only does your original amount go down but your accumulated returns go down. For example, you made 6% one year and 10% the next year, and then the market drops 50%, the whole value drops 50%. Now, if we take that same example with an indexed equity annuity and you made 6% one year and 5% the next year and then the market drops 50%. Well, the principal plus the annual returns are locked in, and you get to keep what you've earned.

REASON #4: Tax Deferral.

Possibly there's a 15-25% benefit depending on your tax bracket. It's only a benefit if it's unqualified money. So, you do get tax deferral benefit by purchasing an annuity. It may be a big thing for some people I mean the way I look at it, it doesn't cost any more and if you're having a little bit of a tax problem, who doesn't want to pay fewer taxes today. But you or your beneficiaries are going to have to pay.

REASON #5: Lifetime Income.

It is the only product that I know of that will give you guaranteed income for the rest of your life. Now when I first started working in the business in the 1980s most retirees had what we call the three legs of their investments: they had Social Security coming in, they had pensions coming in, and they took some money out of their savings or investments. So the big majority of their income came with guarantees. Fast forward to today, very few people out there have a pension. So the only guaranteed income they have coming in is maybe from Social Security. Sometimes people just want to have a base of income. There's a couple of ways of turning annuities into guaranteed income for life. One way is to annuitize (which I would probably not recommend) and the second way is to purchase one of these riders that gives you a guaranteed income value benefit that goes up every year if you don't use and then it guarantees income for life. In some cases, this gives the retired investor a base, so perhaps they can be a better investor with their other money-sometimes not. It may not be worth the expense especially if you don't use the income rider. It normally costs about 1% annually. The income riders are also fairly complicated and sophisticated, so I went ahead and did a video focusing on that. (insert link)

=====================

Is your current annuity not performing?

You know, the market has been giving double-digit returns for years. However, you aren't seeing it. Are you confused about your income options? Do you have an income rider that you don't understand? Are you an annuity orphan? Well, maybe I can help. I certainly would be glad to. You don't even have to come to the office, just shoot me an email or give me a phone call. I will either contact you directly or respond to your email. If you want to set up a time to talk to me on the phone, give my office a call.

=====================

Sincerely, John Romano CFP®

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years experience in the financial field. John is a Registered Representative with Securities America, Inc. (member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated.

Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated.

John Romano, CFP®

305 Skyline Drive, Suite 3, Lady Lake, FL 32159

Phone: 352-753-8590

Email: John@RomanoJohn.com

WHY YOU SHOULD PUT THE LEAST AMOUNT OF MONEY INTO FIXED ANNUITIES

I bet you don't hear it often, but if you're going to use fixed index annuities (FIA's) as part of your investment portfolio, make sure you put the least amount in to get the job done. This way the bulk of your money can be positioned into long-term growth. Most investment advisors like myself that have also been in the business for decades know the importance of growing money, not just for the first ten years after retirement, but maybe 20, 30, 40 years. I have plenty of clients that started in their 60s and are now in their 90s. Your retirement might be 20 to 40 years long. So your investments still have to be in a position for/of growth.

Ibbotson studies have shown fixed index annuities have outperformed bonds, especially in the last 7 to 10 years. Furthermore, equities outperform both bonds and fixed index annuities. If you're going to be retired, chances are you're going to rely heavily on your retirement portfolio.

So you can find the full Ibbotson report here:

https://dta0yqvfnusiq.cloudfront.net/commo93759149/2018/02/Ibbotson-White-Paper-5a78d2dea0f40.pdf

MAGIC NUMBER

If you retired today, chances are you have hit your magic number. And no, your magic number is not your lottery number. I have found that most retirees work their whole lives to accumulate a certain value in their investment portfolios, and they think they're going to need that for retirement. So let's just say its $1 million. As an example, you have a husband and wife working, and you get to $1 million, and you say, “That's it, we're done, we are out of here, and we're going to retire.” Now, very rarely do I see people in their 60s say, “Well, I need to have $1 million, but I think I'll wait until I have $3 million.” Most retirees don't want to work into their 70s or 80s. What they want is they want enough money to have a decent retirement.

So yes, $1 million is a lot of money, but if most of your money is in IRAs or qualified plans, well, you're going to lose 15 to 25% when you take it out. Now, if you think about that – if you have $1 million and some of that is taxes, and you may be retired for 30, 40 years, that's not a lot of money. But you've decided that you and your spouse, it's time to enjoy life, and you decide to retire. You look at your finances; you look at your income, you figure it's going to take $80,000 to $90,000 to live on. You got Social Security and some pension income that's going to give you about $40,000, $45,000. So you're going to have to take about $40,000, $45,000 out of this $1 million portfolio.

So once again, like in your accumulation phase, you're back in the position of growing money. And again, as the above Ibbotson studies show, equities have historically done double what bonds do and not quite double what fixed index annuities have done over a long period. Equities give the most bang for your buck, but most retirees can't go all in because of the volatility. So instead, they choose an allocation to dampen the volatility. Unfortunately, bonds and CD rates are still pretty low, and that puts annuities into play. Obviously, if interest rates were better like 5 or 6% on CD's, that would be the better option.

LET'S TALK ALLOCATION

As an example, let's say you're the above-stated couple. You need about 4- 4.5%. You would gauge yourself as very conservative. You're nervous about the markets, and you're nervous about retirement. So you probably should have an allocation maybe 5 or 10% in cash or short-term bonds. That should provide you money to live off next four years. Maybe have 20% into fixed index annuities just because of the higher historical return of cash or bonds and the guarantees. Remember the guarantee of the fixed index annuity is not losing 20 -40% and then 50% in the next bear market. You have upside potential that's capped, but that's alright. You're giving up downside potential to have limited upside potential. So this is still going to leave you 60 - 70% that you're going to need to employ in long-term growth. So what's the problem?

THE BEAR MARKET IS THE PROBLEM

You will find investing during retirement is much different than you were investing during your employment years. In my experience, your success in retirement is going to be determined by how much of your total portfolio you've allocated to equities, what allocation of asset classes you're using, and even more importantly, what is the investing strategy that's being employed today. Let's say you only need to withdrawal 1 -2% per year instead of the 4 or 5% like the above couple. Now, if you have the same $1 million and maybe one of you have a good pension income, but you can actually invest more conservative. Well, it's kind of counterintuitive, but because you have more, you can take less risk, but it doesn't mean you have to.

If you're the type of couple that wants to enjoy life more, you're willing to accept more muted returns; maybe you should only have 30 or 40% into the markets. You could allocate maybe 10 to 20% into short-term bonds or CDs, maybe 30% into fixed index annuities, and maybe the rest into equities. You're going to need to have a percentage of this in long-term growth. I would use short-term fixed index annuities with maturities of five to seven years. Once again, I would recommend spending your cash and your short-term bonds first. The next bucket to access just may be the annuity bucket.

The real key is to have a plan. Very few people have come into my office, or I've talked to on the phone that has a distribution income plan from their portfolio. Every investor is different. I've found that is not only every investor different, but every investor is different during bull markets and bear markets. Years ago, people used to tell me that they were long-term buy-and-hold investors. Well, a couple of bear market beat down changes the fearless investor into a conservative investor. So put the least amount of money into annuities that you can to get the job done.

You don't want to do any more than you have to. If you're concerned that your allocation is wrong, you're concerned that there's no distribution plan, you're wondering can annuities help you, and you're concerned that you seem to have an investment plan that's not keeping up with market returns.

==============================

Is your current annuity not performing?

You know, the market has been giving double-digit returns for years. However, you're not seeing it. Are you confused about your income options? Do you have an income rider that you don't understand? Are you an annuity orphan? Well, maybe I can help. I certainly would be glad to. You don't even have to come to the office, just shoot me an email or give me a phone call. I will either contact you directly or respond to your email. If you want to set up a time to talk to me on the phone, give my office a call.

==============================

Sincerely, John Romano CFP®

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years experience in the financial field. John is a Registered Representative with Securities America, Inc. (member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated.

Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated.

John Romano, CFP®

305 Skyline Drive, Suite 3, Lady Lake, FL 32159

Phone: 352-753-8590

===================================================================

1. Guarantees are based on the claims paying ability of the insurance company

2. Situations contained in articles are hypothetical examples provided for illustrative purposes only.

Fixed index annuities are intended for retirement or other long-term needs. It is intended for a person who has sufficient cash or other liquid assets for living expenses and other unexpected emergencies, such as medical expenses. Fixed Index Annuities are insurance contracts and should be considered complex products. Fixed Index Annuities are not stock market investments. You are never invested in the index itself. Fixed index annuities are subject to possible surrender charges and a 10% IRA early withdrawal penalty prior to age 50 Y. Early withdrawal charges and Market Value Adjustments (MVA) may apply. Withdrawals may reduce any optional guaranteed amounts in an amount more than the amount of the withdrawal. Taxable distributions are subject to ordinary income taxes.

Current minimum return, principal value and prior earnings guarantees by the issuing insurance company, subject to their claims paying ability, and contract provisions.

Indexed interest is calculated and credited (if applicable) at the end of an annual interest term based on the strategy selected and will be adjusted for any caps, spreads, performance triggers or participation rates, all which can limit or reduce the interest credited. Outcomes may differ based upon the interest crediting strategy selected and assume compliance with the product's benefit rules. Not all strategies are available in all states and firms. Amounts withdrawn from the indexed account before the end of an interest term will not receive indexed interest for that term. Interest credited to the indexed accounts is affected by the value of outside indexes and the annuity will not experience returns identical to the index's performance. Values based on the performance of any index are not guaranteed. The contract does not directly participate in any outside investment.

Indexed interest caps, fixed account interest rates and margin rates may be reset at the end of each interest term. Interest Rates, indexed interest caps and margin rates are subject to change without notice.

Tax qualified contracts such as IRAs, 401(k)s, etc. are tax deferred regardless of whether or not they are funded with an annuity. If you are considering funding a tax-qualified retirement plan with an annuity, you should know that an annuity does not provide any additional tax-deferred treatment of earnings beyond the tax-qualified plan or program itself. However, annuities do provide other features and benefits such as death benefits and income payment options.

Annuity contracts have terms and limitations for keeping them in force. Although Fixed Index Annuities guarantee no loss of premium due to market downturns, deductions from your Accumulation Value for additional optional benefit riders could under certain scenarios exceed interest credited to your Accumulation Value, which would result in loss of premium. They may not be appropriate for all. Please contact your financial professional or insurance producer for complete details.