#1 Job - A Retiree should Stay Retired One of the advantages I have over most new retirees and certainly some advisors is that I know ... READ MORE

#1 Job - A Retiree should Stay Retired One of the advantages I have over most new retirees and certainly some advisors is that I know ... READ MORE

Will you Outlive Your Money or Will you have Income for Life ? I believe this last bad market was a game-changer for most retirees. It reminded me of how investors reacted in the 1980-81 market.... READ MORE

Will you Outlive Your Money or Will you have Income for Life ? I believe this last bad market was a game-changer for most retirees. It reminded me of how investors reacted in the 1980-81 market.... READ MORE

What is Your Retirement Number? $ 1000? $ 1400 ? What is your actual Number of how much dividends and interest your portfolio earns? Is it $ 1,000 monthly? Is it $ 2,000 monthly? Is it $ 4,000 monthly? If you are taking out $6000 a month and amount of real income is about $1000 a month, the word no one wants to hear if you work for Nasa is Houston,...READ MORE

What is Your Retirement Number? $ 1000? $ 1400 ? What is your actual Number of how much dividends and interest your portfolio earns? Is it $ 1,000 monthly? Is it $ 2,000 monthly? Is it $ 4,000 monthly? If you are taking out $6000 a month and amount of real income is about $1000 a month, the word no one wants to hear if you work for Nasa is Houston,...READ MORE

Reaching Retirement - Now What ? You've worked hard your whole life anticipating the day you could finally retire. Well, that day has arrived! But with it comes the realization that ... . READ MORE

Reaching Retirement - Now What ? You've worked hard your whole life anticipating the day you could finally retire. Well, that day has arrived! But with it comes the realization that ... . READ MORE

Sustainable Withdrawal Rates...A withdrawal rate is the percentage that is withdrawn each year from an investment portfolio. If you take $20,000 from a $1 million portfolio, your withdrawal rate that year ... READ MORE

Sustainable Withdrawal Rates...A withdrawal rate is the percentage that is withdrawn each year from an investment portfolio. If you take $20,000 from a $1 million portfolio, your withdrawal rate that year ... READ MORE

====================================================

====================================================

======================================================

Will You Outlive Your Savings or Will

you have Income for Life?

Read on to see how the FREE customized

Morningstar Report will help you decide

if you have the right retirement plan in place…..

I believe this last bad market was a game-changer for most retirees. It reminded me of how investors reacted in the 1980-81 market. I had recently gotten into the investment business and recall a time in 1982 when I asked a client about investing in equities. He reacted as if I’d just thrown up on his shoes! People seemed to have an aversion to

Equities back then. The stock market had done nothing but go down from 1968-19821 so most retirees at the time had had enough of the market. They were creating income streams from C.D.’s, bonds, etc. Most of them were comfortable to have a large percentage of their money in fixed income, and were taking interest from those investments and dividends out of their stocks.

I believe the bear market we’ve just been through is a similar “game changer” for many retirees. By experiencing two bear markets in the last 10 years, many retirees have come to the point that they know they need to do something different.

I believe retirees have to get “back to the future” –back to what retirees were doing after other bad markets. They need to change the game plan from owning all equities, and hoping for growth, to a much more balanced portfolio of fixed income, guaranteed income payments and high paying dividend equities. I think they need to be more concerned about their present income streams than about leaving their beneficiaries large sums of money.

Good question, Mr. and Mrs. Retiree! Let me talk to you about an investment strategy I’ve been using since 2001. This strategy focuses on predictable, reliable income streams rather than shooting for the moon in 100% equities. How can you avoid outliving your money, you ask?

- Rule #1--Create an income plan for your monthly deficit

- Rule #2--Spend interest/dividend income—not principal

- Rule #3--Diversify from equities

- Rule #4--Use guarantees when possible

- Rule #5--Don’t buy and hold

- Rule #6--Have liquidity so you can be adaptable

Diversification can be thought of as spreading your investment dollars into various asset classes to add balance to your portfolio. Although it doesn’t guarantee a profit, it may be able to reduce the volatility of your portfolio.

Many retirees are utilizing a hope strategy--- I hope I don’t have to go back to work. I hope the market goes up. I hope my expenses go down. I hope I win the lotto. Well, like most people, I hope for those things, but I’m not counting on it. Let’s try to build a process that gives us a basic game plan for the next 5, 10, 15, 20 year periods. You can do this by utilizing fixed income and guaranteed income payments, but first you must have a plan. Now, let’s start with your current guaranteed income streams. Let’s add up your monthly expenses Do your expenses exceed your guaranteed income (probably pension and Social Security)? If so, you have a monthly income deficit. You are not the government. You can’t run income deficits for very long.

In my experience, very few retirees today survive only off of their pension and Social Security. They normally supplement their income with withdrawals from their investments. Even though there may be a few retirees that don’t need the supplement, things can happen to change that situation.

Let me give you an example. Mr. & Mrs. Retiree have pension and Social Security income that exceeds their current expenses. Perhaps they also have land contracts or deferred compensation packages that run out in a certain period of time—say five to ten years. Perhaps their income right now is adequate. But what happens if one of them passes away? Normally, at least the Social Security income of one is lost and anywhere from zero to 100% of the pension is lost. Planning for today is important, but planning for the future is equally critical.

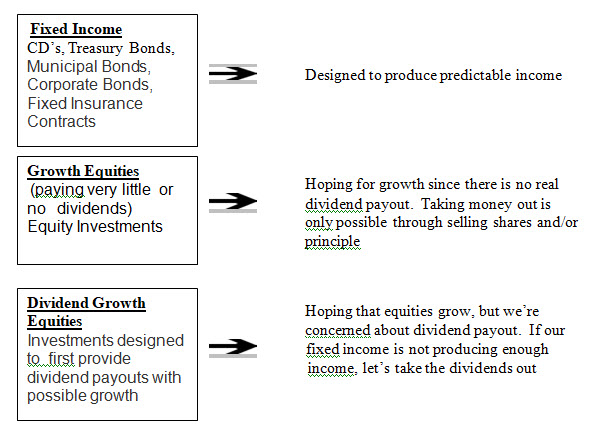

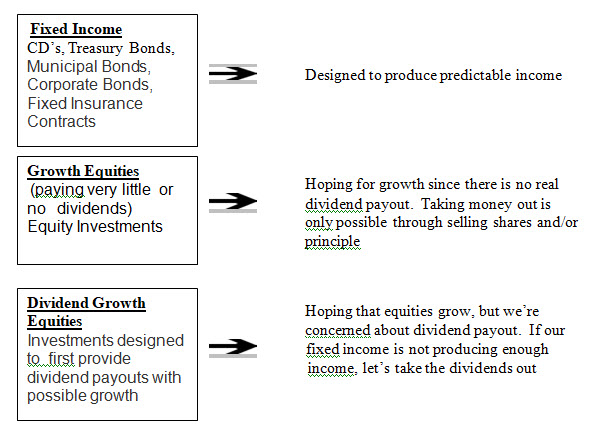

Now, if you have been a regular reader of this newsletter, you know for the last 8-10 years, I have identified three basic investment types. All investments normally will fit into one of these categories. Some may be applicable to more than one category.

While discussing fixed income, it might be important to reference the actual returns of the market. Some people have called this the lost decade of the stock market. In the last 10 years, when, as of May 1st, 2009, the S&P 500 returned -2.478%2, perhaps it wouldn’t have been so bad to earn 5, 6 or 7% in CDs or bonds in this time period.

Do you remember back in high school algebra class when you would be given a problem to solve for “X”? Growing up in Daytona Beach, I attended a high school where you could see the beach from the second floor, and my algebra class was on the second floor. We could see the beach from the window, so it was common for us to stare out the window—at least for me, the sight of the beach was a distraction…… until the teacher asked us to “Solve for ‘X’”, when I would immediately snap out of my daze and respond to the call for action! Fortunately, this is not algebra we’re talking about—it’s simple math. And our problem is to solve for deficit income—aka “X”. To do that, the goal should be to have a plan that produces sufficient income through interest and dividend payments without selling principle.

Though some people of retirement age are working to supplement their income, most retirees are taking out distributions monthly from their investments. Unfortunately, in many cases, their portfolio may not be producing enough income to cover the total amount they need. So, they are forced to request a certain dollar amount be sent to them each month, perhaps without a full understanding of what’s happening to their investment as they do so. In many cases, shares are being sold and their principal is dwindling continually----which eventually may lead to a principal deficit.

If you are running an income deficit now, it probably stands to reason that unless you go back to work or inherit money, the problem is not going to solve itself. The good news is, since we now know your monthly deficit, it can likely be solved for the future by utilizing fixed income investments. For example, if you have a total of $400,000 of assets to invest and your monthly deficit is $1,000 a month and your current portfolio is producing no income, we probably need to shift enough into the fixed income box to produce $1,000 a month. We can utilize CDs, bonds, etc.…to generate that $1,000 a month. The good news is that there is still over half the portfolio to create future income streams.

In doing so, the retiree is working against Rule #2—which is to Spend Interest/dividend income-not principal. You especially do not want to be in this position in an uncooperative stock market. If you start with 10,000 shares worth $100 per share, and you sell 300 shares to generate $30,000 of income per year, you are reducing your principal. If it happens that during this time, the stock market is also doing poorly, you have to sell more shares to get the same dollar amount per month, because the price of the shares has gone down. This forces you to sell an increasing percentage of a decreasing portfolio. This is not a very productive enterprise.

►Due to the uncertain economic times facing retirees, they are worried about outliving their money ,how to reduce their risk and questioning if their portfolio is going to last…………continue reading to see how you can obtain the free customized Morningstar Report……………

Since we’re probably able to predict your income deficits now and in the future, let’s not only anchor it today, let’s anchor it for the next 5 to 10 years. The focus on investing a block of your money is to create income streams for the next 5 to 10 year period of time. That can be accomplished by creating a CD/bond ladder for the next 5 to 10 years. It’s relatively simple to buy different maturities of CDs or bonds that mature 1 year, 2 years, 3 years, 5 years, 7 years, 10 years, so we know exactly what kind of money is going to be coming in for that period of time. Now you know your potential future income stream! It allows us to invest for your next 10 to 20 years by utilizing the proper investments. Perhaps you’re done with equities. If that’s the case, we’ll focus on fixed investments and reinvest interest and dividends to build up the portfolio. If you’re comfortable with equities, we’ll focus more on dividend equities. Just be sure to reconsider what happened to 90’s style buy and hold strategies in 2000-2002.

Two Keys to the design of your income plan are

◙ Ensuring sufficient income streams over the next 5 to 10 years

◙ Understanding where you are and where you want to be (goals)

►In health cases, people will get a second opinion, and this is a great way to get the FREE customized…………….report……………………..

►I am offering a FREE Morningstar Report that will help you understand how to apply these concepts to your portfolio. This is a POWERFUL Report addressing such topics, as sector, income and risk management techniques.

►To insure that you have access to this information, I am offering the powerful report absolutely FREE!! THAT’S RIGHT ABSOLUTELY FREE, WITH NO OBLIGATION! WHY WAIT? CALL THE OFFICE: (352)753-8590 * TOLL-FREE: (800)-393-8447 OR EMAIL: john@romanojohn.com

Sincerely,

John Romano, CFP

About the Author

John Romano is a Certified Financial Planner and Registered Representative with Securities America, Inc. (member of FINRA and SIPC). John is also an Investment Advisor Representative with Securities America Advisors. John has been involved in Financial Planning since 1980.

Representatives of the Securities America companies do not provide tax advice. Please consult a tax professional in your state concerning your specific situation.

Securities offered through Securities America, Inc., member FINRA/SIPC and advisor services offered through Securities America, Advisors, Inc. John Romano, Representative.

Trading instructions sent via e-mail may not be honored. Please contact my office at (352) 753-8590 or Securities America, Inc. at (800-747-6111) for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential, and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated.

305 Skyline Drive, Suite 3 Lady Lake FL 32159

(352) 753-8590 * Fax: (352) 205-8591 * john@romanojohn.com

Securities America, Inc., member FINRA/SIPC * Investment Advisor

Representative, Securities America Advisors, Inc.

-----------------------------------------------------------------------------------------------------------------------------------------------

The opinions and forecasts expressed are those of the author, and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results. -----------------------------------------------------------------------------------------------------------------------------------------------

1 http://www.taloneight.com/SecularMarket6882.html

2 http://online.wsj.com/article_email/SB124001598168631027-lMyQjAxMDI5NDIwNDAyMTQ1Wj.html

3 With your investments, you should make your own determination with the help of a financial professional whether a particular investment is consistent with your objectives, risk tolerance and financial situation. Information provided is general in nature. It is not intended to be, and should not be construed as legal, financial, tax advice, or an investment recommendation.

Investing in higher-yielding bonds is subject to risks including interest rate, default and credit risk. Callable bonds and CDs are also subject to call risk. Callable CDs can be redeemed (called away) by the issuing bank prior to their stated maturity, usually within a given time frame. Callable investments are subject to reinvestment risks. Some fixed income securities are: 1) Not insured by the FDIC, 2) Subject to investment risks, including possibly loss of the principle amount invested. Please review this information carefully with your financial advisor to assure it meets your investment objectives. Interest payments are not guaranteed and are subject to paying ability of issuer.

4 When investing in an annuity it is important to understand all features, benefits, expenses, and risks associated with your investment. Your representative will discuss the specific features of the annuity contract recommended to you, including the following: Taxation: Annuities present tax advantages that may not be available within other investment vehicles. However, investing in an annuity does not present any additional tax advantage if investing money that is already in a qualified account such as an IRA or employer sponsored retirement plan (401k, 403b). If you withdraw money from your annuity, earnings will be taxed at the ordinary income rate, rather than at the capital gains rate applied to investments in non-tax deferred vehicles. This rate may be more or less than the capital gains tax rate, depending upon the investors’ tax rate at the time of the withdrawal. These withdrawals may be subject to a 10% penalty imposed by the IRS if such investments are withdrawn prior to age 59. Please consult with your tax professional about your specific situation.

5 Dividend yield investing may not be suitable for all investors. You should never invest solely on the basis of dividends. Higher dividends are not indicative of the quality of an investment. Additionally, higher dividends will result in lower retained earnings. As dividend yields may not be sustainable, income investors must be sure to analyze an investment carefully and their ability to sustain market fluctuations. Investments paying dividends do not carry lower risk. Dividend payments are not guaranteed by the issuing entity. The issuer can discontinue the dividend at any time.

6 http://online.wsj.com/article/SB120649226977964203.html

7 Standard and Poors Indices 5/18/2009

======================================

Most retirees are concerned today about outliving their income. Very few have a written income plan. Most realize we are the tail end of a great bull market, but all good things come to an end. This may be a good time to stress-test your retirement plan. Maybe I can help. Send me an email or schedule a phone time.

I will get back with you within one business day.

======================================

One of the advantages I have over most new retirees and certainly some advisors is that I know what to do and what not to do when it comes to investing. I have been through multiple Bull and Bear markets. I have helped not just hundreds, but thousands of retirees through the three different retirement phases. It is one thing to know what to do during a great Bull market rally, but you can only learn by experience how to help retirees generate income in a bad market. I know when to zig and not zag.

I have had my office near The Villages, Florida for the past 3 decades. Like most retirement communities it has almost every activity, sport, hobby, club, and/or any other interest available to active retirees. People retire and want to participate in their passions whether it is playing golf on the 25+ different golf courses, bowling, joining the RV club, playing softball, traveling or exploring any of the other interests they’ve had to put off during their working years.

There is one caveat - and you knew that was coming, right? All this fun stuff in retirement costs a little bit extra. And without extra discretionary income coming in, it is pretty hard to do all the stuff you want during your retirement. For example, it’s pretty hard to play golf if you don’t have a golf cart. It’s pretty hard to join an RV club if you don’t have an RV. And it is pretty hard to travel with your friends if you don’t have any money to do so. I think you get the picture, right?

It’s sad to see

People that have retired and due to bad advice or even bad decisions, run out of money.

That’s why I coined the phrase. “A retiree’s number one job is to stay retired”.

Once you retire, you don’t ever want to have to go back to work because you ran out of money. I believe if you surveyed most retirees and ask them if they would rather be working part time at Wal-Mart versus playing golf, bowling, bridge, or pickle ball I’m sure the answer would be the former versus the latter. Furthermore, you probably don’t want to move in with your kids because of running out of money.

So a retiree’s number one priority is to stay retired. It is also helpful to the economy. It gives the younger generation a chance to move up in corporations. If the economy tanks, interest rates go back down, and the market drops, you still want to stay retired. If your grandchild needs help, you want to have enough money to help as well as stay retired.

Most people are smart and they don’t retire until they’ve hit that magic number. Now, everybody has a different number, but basically they have a magic number in their head that tells them, “I should be able to take part of this money out every year, and regardless of what kind of things the market throws at me or whatnot, I should be able to stay retired”.

I have had retirees come to me after they’ve lost a big chunk of their money. Maybe they bought some real estate or perhaps they bought some illiquid investments. Regardless, there’s almost a quiver to their voice when they introduce their financial history to me they’re wondering is there anything I can do to allow them to stay retired.

Well folks, if you’ve lost 50% of your nest egg that you were counting on 100% of it, it is hard to build back up when you’re in the distribution phase of your life. The main purpose of this website is to help you avoid retirement killing mistakes that I’ve seen over the decades.

I have seen just about everything under the sun when it comes to investing. And from past experience, I not only know what to do, but more importantly, what NOT to do. I have a fiduciary responsibility to my clients, so I’m held to a higher standard as well. I am not like your nephew who is fresh out of finance school or an insurance agent who believes that every problem known to mankind can be solved by buying more life insurance. And I am not a robo- advisor that puts your money into an investment model, whether you’re 20 or 70 years old. That machine does not know your risk tolerance and/or your income needs. It’s important to manage your risk tolerance but also to manage whether the investor needs income today or the investor needs growth, or even both!

Does this sound like some of your 3 biggest fears in retirement?

- Running out of money

- Health care costs down the road

- The volatility of the markets upsetting your retirement plan

I’m sure many people who are forced to be unretired did not have that set as a goal. I mean, can you imagine a married couple sitting there together at 65 and saying, “You know what, honey? Let’s go ahead and screw this up so in 7 or 8 years, we have to go back to work. We are probably going to make a lot less money and will have to start at the bottom. And come to think of it, there will probably be a lot of people who won’t hire us because of our age”…

I have noticed there are 5-6 mistakes that are repeated over and over again by retirees:

-Buying illiquid investments that they can’t get out of

-Selling principal to live off of

-Having no retirement income plan (they still may have an investment plan that worked for them when they were in their 40’s)

-Loaning money to kids

-Market volatility

-Not outpacing inflation

I normally don’t meet retirees that make fatal self inflicted errors like gambling away their life savings or living so lavishly they go broke in 4-5 years. What I’ve determined is it’s mostly because of bad advice, illiquid investments, or no retirement income plan.

Many investors find it is easier to accumulate money in their younger years because they are not counting on their investments to support them.

I mean, people choke. Bear markets can make you choke. Let’s say when you are watching different sports on TV and you see somebody that could make that golf shot, three-point foul shot, or throw that touchdown pass. But then all of a sudden the game is on the line and then they choke. The pressure gets to them. It is one thing to choke on that golf shot because there is always another game. But it’s another thing to choke on your retirement plan, because you don’t get a second chance if your money is gone!

Many investors today have never been through bear markets during the retirement phase. Do you know what to do? Well, I do. And I have been helping retirees through multiple bear markets for quite some time now.

What can Bad Advice do?

Let’s just say your nephew just got out of finance school a couple of years ago and he gave you some hot tips on stocks would you trust him completely? Perhaps an insurance advisor tied up the bulk of your money with low-yielding insurance products. What are you going to do?

So you really have no plan, and you chase the next hot thing, and by the time you catch the next hot thing, it’s gotten cold and the value has dropped significantly and your investments tank and also with it, your dreams.

And because of not having a trusted advisor who has created a retirement income strategy, you sit in low-yielding cash just waiting until you feel better—and then you wait for years. Instead of doubling or even tripling your money whenever the market gets going, you just sit there, making nothing. So many years down the road, your nest egg is the same or even lower, but the problem, as you know, is your costs have gone up 50%.

Now, I won’t take a bullet for you, but I will stand shoulder to shoulder with you in helping you navigate the three cycles of retirement. If I only educate you a little to avoid some of these unforced errors, then I’ve accomplished my goal.

If you’d like to see if we could work together, learn the basic concepts and explore your alternatives, then through the miracle of the internet we can now meet with you over video screen sharing, Skyping, phone calls, or email. So it does not matter if you are down the block or across the country.

incerely, John Romano CFP®

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years experience in the financial field. John is a Registered Representative with Securities America, Inc. (member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated.

Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated.

John Romano, CFP®

305 Skyline Drive, Suite 3, Lady Lake, FL 32159

Phone: 352-753-8590

Email: John@RomanoJohn.com

======================================

A withdrawal rate is the percentage that is withdrawn each year from an investment portfolio. If you take $20,000 from a $1 million portfolio, your withdrawal rate that year is two percent ($20,000 divided by $1 million).

However, in retirement income planning, what's important is not just your withdrawal rate, but your sustainable withdrawal rate. A sustainable withdrawal rate represents the maximum percentage that can be withdrawn from an investment portfolio each year to provide income with reasonable certainty that the income provided can be sustained as long as it's needed (for example, throughout your lifetime).

Why is having a sustainable withdrawal rate important?

Your retirement lifestyle will depend not only on your assets and investment choices, but also on how quickly you draw down your retirement portfolio. Figuring out an appropriate withdrawal rate is a key factor in retirement planning. However, this presents many challenges and requires multifaceted analysis of many aspects of your retirement income plan. After all, it's getting more and more common for retirement to last 30 years or more, and a lot can happen during that time. Drawing too heavily on your investment portfolio, especially in the early years, could mean running out of money too soon. Take too little, and you might needlessly deny yourself the ability to enjoy your money. You want to find a rate of withdrawal that gives you the best chance to maximize income over your entire retirement period.

A sustainable withdrawal rate is critical to retirement planning, but it can apply to any investment portfolio that is managed with a defined time frame in mind. It's also fundamental to certain types of mutual funds that are managed to provide regular payments over a specific time period. For example, some so-called distribution funds, which are often used to provide retirees with ongoing income, are designed to distribute all of an investor's assets by the time the fund reaches its targeted time horizon. As a result, the fund must calculate how much money can be distributed from the fund each year without exhausting its resources before that target date is reached.

Tip: Each distribution fund has a unique way of addressing the question of a sustainable withdrawal rate. Before investing in one, obtain its prospectus (available from the fund), and read it so you can carefully consider its investment objectives, risks, charges, and expenses before investing.

How does a sustainable withdrawal rate work?

Perhaps the most well-known approach is to withdraw a specific percentage of your portfolio each year. In order to be sustainable, the percentage must be based on assumptions about the future, such as how long you'll need your portfolio to last, your rate of return, and other factors. It also must take into account the effect of inflation.

Example(s): John has a $2 million portfolio when he retires. He estimates that withdrawing $80,000 a year (adjusted for inflation) will be adequate to meet his expenses. John's sustainable withdrawal rate is four percent, and he must make sure that his portfolio is designed so that he can continue to take out four percent (adjusted for inflation) each year.

Other approaches to withdrawal rates

A performance-based withdrawal rate

With this approach, an initial withdrawal rate is established. However, if you prefer flexibility to a fixed rate, you might vary that

percentage from year to year, depending on your portfolio's performance. Each year, you would set a withdrawal percentage, based on the previous year's performance, that would determine the upcoming year's withdrawal. In years of poor performance, a portfolio's return might be lower than your target withdrawal rate. In that case, you would reduce the amount you take out of the portfolio the following year. Conversely, in a year when the portfolio exceeds your expectations and performance is above average, you can withdraw a larger amount.

Example(s): Fred has a $2 million portfolio, and withdraws $80,000 (four percent) at the beginning of his first year of retirement to help pay living expenses. By the end of that year, the remaining portfolio balance has returned six percent, or $115,200—more than the $80,000 he spent on living expenses. For the upcoming year, Fred decides to withdraw five percent of his portfolio, which is now worth $2,035,200 ($2 million - $80,000 + $115,200 = $2,035,200). That will give him $101,760 in income for the year, and leave his portfolio with $1,933,440. However, during December of that second year of retirement, his portfolio experiences a seven percent loss; by the end of the year, the portfolio has been reduced by the $101,7600 Fred withdrew at the beginning of the year, plus the seven percent investment loss. Fred's portfolio is now worth $1,798,099. Fred reduces his withdrawals next

year--the third year of his retirement--to ensure that he doesn't run out of money too soon. (For simplicity's sake, this hypothetical illustration does not take taxes in account, and assumes all withdrawals are made at the beginning of the year.)

Caution: If you hope to withdraw higher amounts during good years, you must be certain that you'll be able to reduce your spending appropriately during years of lower returns; otherwise, you could be at greater risk of exhausting your portfolio too quickly. And be sure to take inflation into account. Having other sources of reliable, fixed income could make it easier to cushion potential income fluctuations from a performance-based withdrawal rate, and handle emergencies that require you to spend more than expected.

A withdrawal rate that decreases or increases with age

Some strategies assume that expenses in the later years of retirement will be lower as a retiree becomes less active. They are designed to provide a higher income while a retiree is healthy and able to do more.

Example(s): Bill sets a six percent initial withdrawal rate for his portfolio. However, he anticipates reducing that percentage gradually over time, so that in 20 years, he'll take only about three percent each year from his portfolio.

Caution: Assuming lower future expenses could have disastrous consequences if those forecasts prove to be wrong--for example, if health care costs increase even more sharply than they have in the past, or if a financial emergency late in life requires unplanned expenditures. Even assuming no future financial emergencies and no unexpected increases in the inflation rate, this strategy would require discipline on a retiree's part to reduce spending later, which might be difficult for someone accustomed to a higher standard of living.

Other strategies take the opposite approach, and assumes that costs such as health care will be higher in the later retirement years. These set an initial withdrawal rate that is deliberately low to give the portfolio more flexibility later. The risk, of course, is that a retiree who dies early will leave a larger portion of his or her retirement savings unused.

Consider the impact of inflation

An initial withdrawal rate of, say, four percent may seem relatively low, particularly if you have a large portfolio. However, if your initial withdrawal rate is too high, it can increase the chance that your portfolio will be exhausted too quickly. That's because you'll need to withdraw a greater amount of money each year from your portfolio just to keep up with inflation and preserve the same purchasing power over time. For a retirement portfolio, that can become problematic, since the amount withdrawn is no longer available to generate income in future years. An appropriate initial withdrawal rate takes into account that inflation will require higher withdrawals in later years.

Example(s): Jean has a $1 million portfolio invested in a money market account that yields five percent. That gives her $50,000 of income that year. However, inflation pushes up prices by three percent over the course of the year. That means Jean will need more income--$51,500--the next year just to cover the same expenses ($50,000 x.03=$1,500). Since the account provides only

$50,000 of income, the additional $1,500 must be withdrawn from the principal. That principal reduction, in turn, reduces the portfolio's ability to produce income the following year. In a straight linear model, principal reductions accelerate, ultimately resulting in a zero portfolio balance after 25 to 27 years, depending on the timing of the withdrawals. (This example is a hypothetical illustration and does not account for the impact of any taxes.)

Inflation is one reason you can't simply base your retirement income planning on the expenses you expect to have when you first retire. Costs for the same items will most likely continue to increase over your retirement years, and your initial withdrawal rate needs to take that into account to be sustainable.

There's another inflation-related factor that can affect your planning. Seniors can be affected somewhat differently from the average person by inflation. That's because costs for some services that may represent a disproportionate share of a senior's

budget, such as health care and food, have risen more dramatically than the Consumer Price Index (CPI)--the basic inflation measure--for several years. As a result, seniors may experience higher inflation costs than younger people, and therefore might need to keep initial withdrawal rates relatively modest.

What determines whether a withdrawal rate is sustainable?

- Your time horizon: The longer you will need your portfolio to last, the lower the initial withdrawal rate should be. The converse is also true (e.g., you may have health problems that suggest you will not need to plan for a lengthy retirement, allowing you to manage a higher withdrawal rate).

- Anticipated and historical returns from the various asset classes in your retirement portfolio, as well as its anticipated average annual return: Though past performance is no guarantee of future results, the way in which you invest your retirement nest egg will play a large role in determining your portfolio's performance, both in terms of its volatility and its overall return. That, in turn, will affect how much you can take out of the portfolio each year without jeopardizing its longevity.

- Assumptions about market volatility: A financial downturn that reduces a portfolio's value, especially during the early years of withdrawal, could increase the need to use part of the principal for income. It could also require the sale of some assets, draining the portfolio of any future income those assets might have provided. Either of those factors could ultimately affect the sustainability of a portfolio's withdrawal rate.

- Anticipated inflation rates: Determining a sustainable withdrawal rate means making an assumption about changes in the cost of living, which will likely increase the amount you'll need the portfolio to provide each year to meet your expenses.

- The amounts you withdraw each year: When planning your retirement income, your anticipated expenses will obviously affect what you need to withdraw from your retirement portfolio, and therefore affect its sustainability. However, because this is one aspect over which you have at least some control, you may find that you must adjust your anticipated retirement spending in order to make your withdrawal rate sustainable over time.

- Any sources of relatively predictable income, such as Social Security, pension payments, or some types of annuity benefits: Having some stability from other resources may allow greater flexibility in planning withdrawals from your portfolio.

- Your individual comfort level with your plan's probability of success.

As with most components of retirement income planning, each of these factors affects the others. For example, projecting a longer lifespan will increase your need to reduce your withdrawals, boost your returns, or both, in order to make your withdrawal rate sustainable. And of course, if you set too high a withdrawal rate during the early retirement years, you may face greater uncertainty about whether you will outlive your savings.

Example(s): Mary's financial professional tells her that given her current withdrawal rate and asset allocation strategy, there is an 80 percent chance that her retirement savings will last until she's 95 years old. Mary has several choices. If she wants to increase her confidence level--maybe she prefers a 95 percent chance of success--she might reduce her yearly spending, try to increase her portfolio's return by changing her asset allocation, direct a portion of her portfolio into an investment that offers a guaranteed lifetime income, or some combination. On the other hand, if she's a risk taker and is comfortable with having only a 75 percent chance that her portfolio will last throughout her lifetime, she might decide to go ahead and spend a bit more now. (This is a hypothetical illustration only, not financial advice).

Income-only withdrawals vs. income and principal

Many people plan to withdraw only the income from their portfolios, intending not to touch the principal unless absolutely necessary. This is certainly a valid strategy, and clearly enhances a portfolio's sustainability. However, for most people, it requires a substantial initial amount; if your portfolio can't produce enough income to meet necessary expenses, an income-only strategy could mean that you might needlessly deprive yourself of enjoying your retirement years as much as you could have done. A sustainable withdrawal rate can balance the need for both immediate and future income by relying heavily on the portfolio's earnings during the early years of retirement, and gradually increasing use of the principal over time in order to preserve the portfolio's earning power for as long as possible.

Planning to use both income and principal requires careful attention to all the factors mentioned above. Also, in establishing your strategy, you should consider whether you want to use up all of your retirement savings yourself or plan to leave money to heirs. If you want to ensure that you leave an estate, you will need to adjust your withdrawal rate accordingly.

Your decision about income versus income-plus-principal should balance the need for your portfolio to earn a return high enough to sustain withdrawals with the need for immediate income. That can provide a challenge when it comes to allocating your assets between income-oriented investments, and investments that have the potential for a higher return but involve greater volatility from year to year. You may need to think of your portfolio as different "buckets"--for example, one "bucket" for your short-term living expenses, another bucket that could replenish your expenses bucket as needed, and another bucket invested for the long term.

Estimating lifespan

In general, life expectancies have been increasing over the last century. Life probabilities at any age are listed on the Social Security Administration's Period Life Table, available under the Actuarial Publications section of its web site.

Tip: Regularly updated longevity estimates are published in the National Center for Health Statistics' National Vital Statistics Reports.

However, be aware that averages are not necessarily the best guide when determining how long an individual portfolio may need to last. By definition, many people will live beyond the average life expectancy for their age group, particularly those who have a family history of longevity. Also, average life expectancies don't remain static over an individual's lifetime; a 30-year-old may have an average life expectancy of 76, while a 76-year-old may have a life expectancy of 85.

Couples will need to consider both individuals' life expectancies when planning a sustainable withdrawal rate.

Establishing a comfort level with uncertainty

As noted previously, setting a sustainable withdrawal rate requires many assumptions and forecasts about what will happen in the future. Changing any of the variables may increase or decrease the level of certainty about whether your portfolio will last as long as you need it to. Increasing certainty about the outcome may require reducing your withdrawal rate or revising your investment strategy. Conversely, increasing your withdrawal rate, especially in the early years of retirement, may also increase the odds that your portfolio will be depleted during your lifetime.

The challenge is to balance all factors so that you have an acceptable level of certainty about the portfolio's longevity consistent with providing the level of income needed over your expected lifetime and the risk you're willing to take to provide it.

One increasingly common method for estimating the probability of success is the Monte Carlo simulation. This technique uses a computer program that takes information about your portfolio and proposed withdrawal strategy, and tests them against many randomly generated hypothetical returns for your portfolio, including best-case, worst-case, and average scenarios for the financial markets. Based on those aggregated possibilities, the program calculates your portfolio's probability of success. Monte Carlo simulations also allow you to revise assumptions about lifespan, withdrawal rates, and asset allocation to see how changing your strategy might affect your portfolio's chances. Though the process offers no guarantees, it does take into account potential fluctuations in your portfolio's year-to-year returns. The result is a more sophisticated analysis than simply establishing a withdrawal rate based on a constant rate of return on your investments over time.

Some retirement income strategies tackle the question of uncertainty by including not only income sources that pay variable amounts, but also sources that provide relatively fixed or stable income, or lifetime income that is guaranteed. Just remember that the purchasing power of any fixed payment amounts can be eroded over time by inflation.

Once you've established an initial withdrawal rate, you probably should revisit it from time to time to see whether your initial assumptions about rates of return, lifespan, inflation, and expenses are still accurate, and whether your strategy needs to be updated.

Conventional wisdom about withdrawal rates

The process of determining an appropriate withdrawal rate continues to evolve. As baby boomers retire and individual savings increasingly represent a larger share of retirement income, more research is being done on how best to calculate withdrawal rates.

A seminal study on withdrawal rates for tax-deferred retirement accounts (William P. Bengen, "Determining Withdrawal Rates Using Historical Data," Journal of Financial Planning , October 1994), looked at the annual performance of hypothetical portfolios that are continually rebalanced to achieve a 50-50 mix of large-cap (S&P 500 Index) common stocks and intermediate-term Treasury notes. The study took into account the potential impact of major financial events such as the early Depression years, the stock decline of 1937-1941, and the 1973-74 recession. It found that a withdrawal rate of slightly more than four percent would have provided inflation-adjusted income for at least 30 years. More recently, Bengen used similar assumptions to show that a higher initial withdrawal rate--closer to five percent--might be possible during the early, active years of retirement if withdrawals in later years grow more slowly than inflation.

Other studies have shown that broader portfolio diversification and rebalancing strategies can also have a significant impact on initial withdrawal rates. In an October 2004 study ("Decision Rules and Portfolio Management for Retirees: Is the 'Safe' Initial Withdrawal Rate Too Safe?," Journal of Financial Planning ), Jonathan Guyton found that adding asset classes, such as international stocks and real estate, helped increase portfolio longevity (although these asset classes have special risks). Another strategy that Guyton used in modeling initial withdrawal rates was to freeze the withdrawal amount during years of poor portfolio performance. By applying so-called decision rules that take into account portfolio performance from year to year, Guyton found it was possible to have "safe" initial withdrawal rates above five percent.

A still more flexible approach to withdrawal rates builds on Guyton's methodology. William J. Klinger suggests that a withdrawal rate can be fine tuned from year to year using Guyton's methods, but basing the initial rate on one of three retirement profiles. For example, one person might withdraw uniform inflation-adjusted amounts throughout their retirement; another might choose to spend more money early in retirement and less later; and still another might plan to increase withdrawals with age. This model requires estimating the odds that the portfolio will last throughout retirement. One retiree might be comfortable with a 95 percent chance that his or her strategy will permit the portfolio to last throughout retirement, while another might need assurance that the portfolio has a 99 percent chance of lifetime success. The study ("Using Decision Rules to Create Retirement Withdrawal Profiles," Journal of Financial Planning , August 2007) suggests that this more complex model might permit a higher initial withdrawal rate, but it also means the annual income provided is likely to vary more over the years.

Don't forget that all these studies are based on historical data about the performance of various types of investments, and past results don't guarantee future performance.

Market volatility and portfolio longevity

When setting an initial withdrawal rate, it's important to take a portfolio's volatility into account. The need for a relatively predictable income stream in retirement isn't the only reason for this. According to several studies in the late 1990s by Philip L. Cooley, Carl

M. Hubbard, and Daniel T. Walz, the more dramatic a portfolio's fluctuations, the greater the odds that the portfolio might not last as long as needed. If it becomes necessary during market downturns to sell some assets in order to continue to meet a fixed withdrawal rate, selling at an inopportune time could affect a portfolio's ability to generate future income. And a steep market downturn, or having to sell assets to meet unexpected expenses during the early years of retirement, could magnify the impact of either event on your portfolio's longevity because the number of years over which those investments could potentially have produced income would be greater.

Withdrawal rates and tax considerations

When calculating a withdrawal rate, don't forget the tax impact of those withdrawals. For example, your withdrawal rates may need to cover any taxes owed on that money. Depending on your strategy for providing income, you could owe capital gains taxes or ordinary income taxes. Also, if you are selling investments to maintain a uniform withdrawal rate, the tax impact of those sales could affect your withdrawal strategy. Minimizing the tax consequences of securities sales or withdrawals from tax-advantaged retirement savings plans could also help your portfolio last longer.

-------------------------------------------------------------------------------------------------------------------------

Securities offered through Securities America, Inc., A Registered Broker/Dealer, Member FINRA/SIPC. Neither Forefield Inc. nor Forefield AdvisorTM provides legal, taxation or investment advice.

All the content provided by Forefield is protected by copyright. Forefield claims no liability for any modifications to its content and/or information provided by other sources.

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years experience in the financial field. John is a Registered Representative with Securities America, Inc. (member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated.

Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated.

John Romano, CFP®

305 Skyline Drive, Suite 3, Lady Lake, FL 32159

Phone: 352-753-8590

Email: John@RomanoJohn.com

P

=======================================================================

Most retirees are concerned today about outliving their income. Very few have a written income plan. Most realize we are the tail end of a great bull market, but all good things come to an end. This may be a good time to stress-test your retirement plan. Maybe I can help. Send me an email or schedule a phone time.

I will get back with you within one business day.

============================================================

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2018.

============================================================

$ 1000 ? $ 4000 ?

Are You One and Done ?

* Learn how to receive these FREE Reports*

♦ What is your actual Number of how much dividends and interest your portfolio earns?

Is it $ 1,000 monthly? Is it $ 2,000 monthly? Is it $ 4,000 monthly?

If you are taking out $6000 a month and amount of real income is about $1000 a month, the word no one wants to hear if you work for Nasa is “Houston, we have a problem.”

♦ Get probabilities of how long your portfolio may last at your current withdrawal rate

♦ "Probabilities of how your portfolio may perform in a sideways-trading market."

Some years ago I had a first appointment with a retiree who later became a client. He said to me, “ John, one more bear market and I'm done.” I said, “you're done with what?” He replied “I'm done playing golf. I'm probably done eating three meals a day.” He then asked “ Do you know of any high paying jobs for a 77-year-old former engineer?” He was wondering what he could do about it and what actions could he take. You may also have some of these concerns.

It may be nice to learn strategies designed to answer the question of how not to run out of money during retirement, but even more important to the retired investor is the answer to the question, how do I not run out of money? The only way to answer that question is to understand what your Number is (more about your Number later).

Do you wonder if your money will last?

That is an important question to ask yourself. I believe every retiree should understand exactly what's going on in their portfolio. They should know what their number is (the number, once again, which I'll expand on, is the actual dividends and income being generated by your portfolio). Zig Ziglar once said “How can you hit a target you can't see? Even worse, how can you hit a target you don't even have!?” After thirty-plus years' experience in the retirement income field, I cannot stress the importance of having a written plan detailing your investment strategy.

What is your Number ?

I'm not talking about your cholesterol, the number of steps you take a day, or your blood pressure. I'm talking about the key number in your retirement, and it is how much income and dividends the portfolio actually producing. I have been involved in retirement income planning for 30 plus years. I've helped hundreds of retirees and probably talked to thousands via workshops, radio seminars, one on one interviews. I can probably count on one hand the number of retired investors who could tell me how much income and dividends their portfolios produce.

I'm not talking about withdrawals. I'm talking about pure income streams. Most retirees have multiple investment accounts, whether it's brokerage accounts, IRAs, 401(k)s, annuities, bank accounts, but you would probably have better luck finding gold at the bottom of the ocean than wading through these accounts to find your number.

For example, you can call up the company and request them to send you $2,000 a month. They will normally say “sure.” They will usually set up the withdrawal, but rarely discuss if and how much of your portfolio is being sold. In my experience, most of it comes from selling the principal.

----------------------------------------------------------------------------------------------------------------------

Contact US - and ask about your NUMBER

(FREE reports)

----------------------------------------------------------------------------------------------------------------------

Three Types of Markets

Let me write briefly about the three kinds of markets and explain them.

Bull Market. It's a wonderful thing to participate in. We had one that ran from 1981 to 1998, and we just had one that ran from 2009 to around 2018. It was like the Bobby McFerrin song from 1988, “Don't Worry, Be Happy.”

Bear Market. You can think back to 2000 to 2002, 2008 to 2009. There's definitely something to worry about. Nobody's happy. Normally the market is very painful with a drawdown of 20 to 50%.

“Sideways Trading” Market. There are really no positive returns. There are no huge losses. But this matters tremendously if you're doing withdrawals.

The Perfect Storm

As a saltwater fishing enthusiast, one of the movies I enjoyed the most was George Clooney's The Perfect Storm. The story was about a crew aboard an ocean fishing vessel in the Northeast waters. Everything that could go wrong weather-related did go wrong, and there was no escaping it. There was nothing that could have been done. It didn't really matter how big the boat was, or sturdy the boat, or how experienced the captain. The boat was going down. A bear market is kind of like the perfect storm where nothing goes right with investing.

Sideways Trading Market – Honey, we are taking on water back here ?

A boat captain's biggest fear is being out on the water with his family and then hearing a scream from the stern of the boat, “Honey, we are taking on water back here ?” People unfamiliar with boats don't understand that boats take on water. They can take on water from water coming over the side, from a wave or a wake. Many have live bait wells that actually pump water.

Boats have bilge pumps. Now, bilge pumps are actually a pump that sits in the back of the boat in the transom that pumps water out. And when it pumps water out, it can pump out 500 gallons an hour, or even more. The key question is, does your bilge pump remove more water than what is coming in ? And in most cases the answer is yes. But if your bilge pump turns off or the water coming in, for example, from a very large wave, exceeds the bilge pump, you're going to have a problem. I hope you know how to swim.

With a bilge pump the objective is to pump out more water than the boat takes in. Similarly, with retirement income planning the objective is to make sure the portfolio is producing as much income if not more than the amount we are withdrawing. See if this doesn't make economic sense to you. It's far better to take income streams (from dividends and interest) than sell your principal.

Once you sell your principal it is gone forever. Selling principal may be appropriate (as long as the percentage of principal sold is below the market return) is a long-term bull market – think 1992 to 1999, or even years 2009 to 2018.

In a bear or sideways-trading market selling your principal is detrimental to your finances.

Today is a Good Day

Today is a good day! You may ask “Why is today a good day ?” It is because today I am offering three free reports to you that will answer these questions. And we are only able to provide a limited number of reports. We can offer this to only to the first 50 respondents.

Report #1 – What is your Number ? It is designed to tell you the probabilities of what you can withdraw from your portfolio under different situations [1].

Report #2 – A written plan to help you forecast your income and expenses going forward.

Report #3 – A customized Morningstar report to help you identify if a portfolio is appropriate for retirees.

All these reports are designed to help you answer these questions. “What is my number?”, “How much can I safely withdraw from this portfolio?,” “If we continue in the sideways-trading market, how will my portfolio do?”, and “Am I prepared for the next bear market?”

Ask yourself, “does it make economic sense to know what your number is ?

John Romano, CFP® *

Contact US - and ask about your NUMBER (FREE reports)

* John Romano, CFP® has over 30 years experience in the financial field. John is a Registered Representative with Securities America, Inc. (member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida and surrounding areas. He is an active member in good standing with the Financial Planning Association (FPA) and an advisor in good standing with the Certified Financial Planning Board.

[1] Dividend yield investing may not be suitable for all investors. You should never invest solely on the basis of dividends. Higher dividends are not indicative of the quality of an investment. Additionally, higher dividends will result in lower retained earnings. As dividend yields may not be sustainable, income investors must be sure to analyze an investment carefully and their ability to sustain market fluctuations. Investments paying dividends do not carry lower risk. Dividend payments are not guaranteed by the issuing entity. The issuer can discontinue the dividend at any time. Dividend payments reduce the price of the security by the amount of the paid dividend.

The opinions and forecasts expressed are those of the author, and may not actually come to pass. This information is subject to change at anytime based on market and other conditions and should not be construed as investment advice or a recommendation of any specific security. Past performance does not guaranteed future results.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated.

Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated.

305 Skyline Drive Suite 3

Lady Lake FL 32159 Phone:

PHONE: 352-753-8590

=======================================================

Dear Folks,

I wrote this book about 5-6 years ago – the fundamentals still apply –get your FREE copy. We only have a small supply of these books left, so ask for yours today ! Regards, John.

Free Book: Distribution Strategies For Retirement

How to Increase Cash Flow and Maintain Lifestyle

Are you going to Stay Retired ?

Are you wondering if you have enough money to stay retired? Are you concerned about having the ability to continue your lifestyle? Do you have a written retirement plan? Many retirees are wondering today if they have not only enough of a nest egg to stay retired, but also what method to use to distribute it. It is not only the size of your portfolio but how you distribute it.

Have you been coached or told that it is perfectly acceptable to sell a piece of your principal every month to live off of? Unfortunately many retirees are using that very strategy today. When you sell your principal every month it becomes almost a race to death...which dies first you are your nest egg? The key is understanding the alternatives to selling your nest egg.

Know the facts before you take another distribution. GREAT NEWS!! I have written this book on retirement distribution strategies just for someone like you! I promise not to give you a lot of theory and fancy computer models but just a commonsense approach I have used with success for over 34 years in helping retirees find solutions to their retirement needs. If you are not 100% confident about your retirement plan then you need to read this book!

Here's What You'll Learn From this Compelling Book :

- Ways to Increase Cash Flow and Maintain Lifestyle

- Determining Your Safe Withdrawal Rate

- The 3 methods of Retirement Income Distribution

- Which investments to liquidate first

- The Ways to minimize taxes on distributions

- Avoiding the dollar price erosion strategy

- Avoiding the Selling Principal strategy

I feel so strongly about the importance of these topics and others discussed

in this book that I am offering it free to visitors to my website. *

( * The book is offered on Amazon for $19.95 )

“ Remember it is not only the size of your Portfolio that matters but how you Distribute it.

===========================================================

You've worked hard your whole life anticipating the day you could finally retire. Well, that day has arrived! But with it comes the realization that you'll need to carefully manage your assets to give them lasting potential.

Review your portfolio regularly

Traditional wisdom holds that retirees should value the safety of their principal above all else. For this reason, some people shift their investment portfolio to fixed-income investments, such as bonds and money market accounts, as they approach retirement. The problem with this approach is that you'll effectively lose purchasing power if the return on your investments doesn't keep up with inflation.

While generally it makes sense for your portfolio to become progressively more conservative as you grow older, it may be wise to consider maintaining at least a portion of your portfolio in growth investments.

---------------------------------------

When considering a rollover, to either an IRA or to another employer's retirement plan, you should consider carefully

the investment options, fees and expenses, services, ability to make penalty-free withdrawals, degree of creditor protection,

and distribution requirements associated with each option.

1 To qualify for tax-free and penalty-free withdrawal of earnings, a Roth IRA must meet a five-year holding requirement and the distribution must take place after age 59½, with certain exceptions.

-------------------------------------

Spend wisely

Don't assume that you'll be able to live on the earnings generated by your investment portfolio and retirement accounts for the rest of your life. At some point, you'll probably have to start drawing on the principal. But you'll want to be careful not to spend too much too soon. This can be a great temptation, particularly early in retirement.

A good guideline is to make sure your annual withdrawal rate isn't greater than 4% to 6% of your portfolio. (The appropriate percentage for you will depend on a number of factors, including the length of your payout period and your portfolio's asset allocation.) Remember that if you whittle away your principal too quickly, you may not be able to earn enough on the remaining principal to carry you through the later years.

Understand your retirement plan distribution options

Most pension plans pay benefits in the form of an annuity. If you're married, you generally must choose between a higher retirement benefit paid over your lifetime, or a smaller benefit that continues to your spouse after your death. A financial professional can help you with this difficult, but important, decision.

Other employer retirement plans, such as 401(k)s, typically don't pay benefits as annuities; the distribution (and investment) options available to you may be limited. This may be important because if you're trying to stretch your savings, you'll want to withdraw money from your retirement accounts as slowly as possible. Doing so will conserve the principal balance, and will also give those funds the chance to continue growing tax deferred during your retirement years.

Consider whether it makes sense to roll your employer retirement account into a traditional IRA, which typically has very flexible withdrawal options.1 If you decide to work for another employer, you might also be able to transfer assets you've accumulated to your new employer's plan, if the new employer offers a retirement plan and allows a rollover.

Plan for required distributions

Keep in mind that you must generally begin taking minimum distributions from employer retirement plans and traditional IRAs when you reach age 70½, whether you need them or not. You might consider spending these dollars first in retirement.

If you own a Roth IRA, you aren't required to take any distributions during your lifetime. Your funds can continue to grow tax deferred, and qualified distributions will be tax free.2 Because of these unique tax benefits, it generally makes sense to withdraw funds from a Roth IRA last.

Know your Social Security options

You'll need to decide when to start receiving your Social Security retirement benefits. At normal retirement age (which varies from 66 to 67, depending on the year you were born), you can receive your full Social Security retirement benefit. You can elect to receive your Social Security retirement benefit as early as age 62, but if you begin receiving your benefit before your normal retirement age, your benefit will be reduced. Conversely, if you delay retirement, you can increase your Social Security retirement benefit.

--------------------------------------

The decision of when and how to tap your Social Security

benefits can be complicated. You might want to review

your options long before your planned retirement date

to be sure you fully understand the pros and cons of each

--------------------------------------

Facing a shortfall

What if you're nearing retirement and you determine that your retirement income may not be adequate to meet your retirement expenses? If retirement is just around the corner, you may need to drastically change your spending and saving habits. Saving even a little money can really add up if you do it consistently and earn a reasonable rate of return. And by making permanent changes to your spending habits, you'll find that your savings will last even longer. Start by preparing a budget to see where your money is going. Here are some suggested ways to stretch your retirement dollars:

- Refinance your home mortgage if interest rates have dropped since you obtained your loan, or reduce your housing expenses by moving to a less expensive home or apartment.

- Access the equity in your home. Use the proceeds from a second mortgage or home equity line of credit to pay off higher-interest-rate debts, or consider a reverse mortgage.

- Sell one of your cars if you have two. When your remaining car needs to be replaced, consider buying a used one.

- Transfer credit card balances from higher-interest cards to a low- or no-interest card, and then cancel the old accounts.

- Ask about insurance discounts and review your insurance needs (e.g., your need for life insurance may have lessened).

- Reduce discretionary expenses such as lunches and dinners out.

By planning carefully, investing wisely, and spending thoughtfully, you can increase the likelihood that your retirement will be a financially comfortable one.

Securities offered through Securities America, Inc., A Registered Broker/Dealer, Member FINRA/SIPC. Neither Forefield Inc. nor Forefield AdvisorTM provides legal, taxation or investment advice.

All the content provided by Forefield is protected by copyright. Forefield claims no liability for any modifications to its content and/or information provided by other sources.

John Romano, CERTIFIED FINANCIAL PLANNER™, has over 30 years experience in the financial field. John is a Registered Representative with Securities America, Inc. (member of the FINRA and SIPC), and an Investment Advisor Representative with Securities America Advisors. He has prepared hundreds of reports for retirees to assist in their retirement income planning needs. He is dedicated to providing portfolio analysis, dividend and income information, and investment management services to retirees (and those preparing to retire) in The Villages, Florida, and throughout the United States.

The opinions and forecasts expressed are those of the author, and may not actually come to pass. This information is subject to change at any time, based on market and other conditions and should not be construed as a recommendation of any specific security or investment plan. Past performance does not guarantee future results.

Securities offered through Securities America, Inc. Member FINRA/SIPC, John Romano CFP® Registered Representative. Advisory Services offered through Securities America Advisors, Inc. John Romano Investment Advisor Representative. Romano Income Strategies and Securities America are not affiliated.

Trading instructions sent via e-mail may not be honored. Please contact my office at (352)753-8590 or Securities America, Inc. at (800) 747-6111 for all buy/sell orders. Please be advised that communications regarding trades in your account are for informational purposes only. You should continue to rely on confirmations and statements received from the custodian(s) of your assets. The text of this communication is confidential and use by any person who is not the intended recipient is prohibited. Any person who receives this communication in error is requested to immediately destroy the text of this communication without copying or further dissemination. Your cooperation is appreciated.

305 Skyline Drive, Suite 3, Lady Lake, FL 32159

Phone: 352-753-8590

Email: John@RomanoJohn.com

July 27, 2018

Prepared by Broadridge Investor Communication Solutions, Inc. Copyright 2018

Reaching Retirement - Now What ?

Reaching Retirement - Now What ?